Start Up Loan

If you're a new member looking to borrow from Discovery Credit Union for the first time, to help cover the bills or unexpected expenses.

With the Start up Loan, you could access to a loan of up to £500 at a fair, affordable rate with no early repayment charges. Loan repayable over 6 months maximum.

This loan will need to repaid in full before any further loans will be considered.

All applications are subject to affordability and credit checks.

3% per month (42.6% APR)

Discovery Loan

If you have borrowed from us previously and have repaid the loan and looking to borrow again to help cover the bills or unexpected expenses.

With the Discovery Loan, you could access to a loan of up to £1000 at a fair, affordable rate with no early repayment charges. Loan repayable over 12 months maximum.

Loans to repeat borrowers, will be able to top up their loan after 60% of the loan has been repaid.

This loan is only available to members who have previous satisfactory loan history with Discovery Credit Union.

Subject to affordability and credit reference checks

3% per month (42.6% APR)

Standard Savers Loan

For regular savers who wish to borrow an amount based on their savings.

New, first time, borrowers may apply for up to twice (2x) their savings.

Loans to first time borrowers (no previous Discovery CU loan history) may be restricted to a maximum of £1250.00 and a loan term of 12 months. This loan would need to be repaid in full, before further loans will be considered.

Repeat borrowers may apply for up to three (3x) their savings.

Loans to repeat borrowers, will be able to top up their loan after 60% of the loan has been repaid.

Excludes any balance held in Christmas Saver.

Loan are subject to affordability and credit checks.

The multiple of savings applied to loan value is not guaranteed.

Interest varies depending on the loan amount

Secure Savers Loan

For members with savings wishing to borrow an amount equal to, or less than, their savings balance.

Excludes any balances held in Christmas Saver account.

0.69% per month (8.3% APR)

Freedom Loan

For members employed with our payroll partners and saving through payroll deductions looking to borrow larger sums of money but have not yet built up enough savings.

Loans to first time borrowers (no previous Discovery CU loan history) may be restricted to a maximum of £1250.00 and a loan term of 12 months. This loan would need to be repaid in full, before further loans will be considered.

All loans are subject to affordability and credit checks.

Interest varies depending on the loan amount

Once you have registered your account with the Members Area. Go to Log In

Once logged in you will see the heading Apply for a Loan.

Follow the steps to apply based on the appropriate loan you would qualify for

Start Up Loan, for all new first time borrowers, with no savings

Discovery Loan, for new members and members without savings.

Standard loan, for members who have built up some savings and wish to apply for a loan equal to or based on borrowing history either 2x or 3x savings balance.

Secured loan, for members who wish to borrow against their savings, either equal to or less savings held.

Freedom loan, for members who are employed by our Payroll Partners.

Please remember you will need to upload your supporting documents to the application. See How to prove your income.

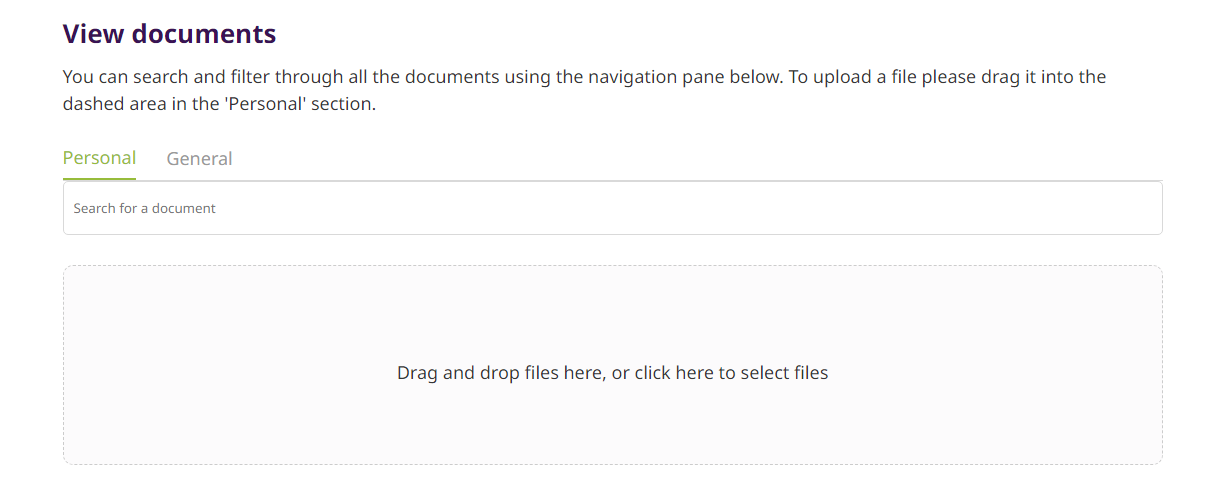

These documents must be uploaded via the online portal using the DOCUMENTS tab

Load documents by either dragging them to this space or clicking and then searching for them in the folder where they were downloaded or saved to.

Most people may need to borrow money at some point in their lives. By joining the Credit Union, our members borrow money for all sorts of reasons - to help pay for Christmas; family holidays; a new car; carrying out home improvements; for covering the cost of replacing household items or consolidating debts.

We have found that people looking to borrow only a few hundred pounds find they have limited choices. Banks and building societies don't often offer smaller amounts for shorter terms.

If you don't have a good credit history, or don't have a bank account, you may not be able to get credit at all on the high street.

People in our "common bond" who need to borrow smaller sums often end up paying huge amounts of interest through borrowing from pay day loan companies or through lenders who call to your house. We also know that trying to afford the repayments on these loans can cause a great deal of stress and put a real strain on your household budget. That's where Discovery Credit Union can help!

Our Discovery Loan is designed to give people access to up to £500, without the need to save first, subject to affordability.

Each application is considered on its own merits and with the utmost confidence. It is our policy to meet the borrowing requirements of as many members as possible, depending on the available funds.

As a Credit Union, we use the savings of other members to advance loans, we do not have other shareholders as investors, nor do we incur borrowings to make loans available.

As a responsible lender, we will never knowingly place a member in more debt than they can afford. As an ethical lender, we try to help you to be financially responsible through budgeting, planning and saving.

- We only lend to members of the Credit Union, please see Join Us to proceed to join Discovery Credit Union.

- You must be 18 or over

- You will be expected to save alongside loan repayments. (automatic)

- Our Secure Savers Loans and Standard Savers Loans require you to show a regular pattern of saving before applying for a loan

- Loans are secured against your shares (savings) and will not be accessible whilst a loan is outstanding, only balances in excess the loan balance will be available.

- All loan applications may be subject to Credit Reference checks.

- No arrangement fees

- No penalty for early repayment

- Fair lending decisions

- Free Life Insurance on loan balances (subject to age and health restrictions)

Applications for loans are made via our members area. To be able to apply for a loan you will need have been accepted as member and made the minimum membership payment.

Should you not have access to a smart phone, tablet or computer, we do have loan applications available at our office, check the opening hours.

Alternatively, the application form can be downloaded from the website, see Downloadable files and returned to the office or posted to us. Please note paper-based applications will take longer to assess.

To support your application, you will need to provide acceptable proof of income (see below) and recent bank/Post Office statements*.

We accept following proof of income:

- a copy of two months' worth of up-to-date bank statements. Learn More

- we may ask for an Open banking link in your loan application, this will allow us a one time snapshot of all your bank accounts, which is much easier than collecting bank statements.

- copies of your two most recent salary slips; if paid weekly copies of the last 8 week’s payslips

- a copy of your DLA/PIP/Universal Credit benefit award letter

- SAAS and/or bursary award letter

- a copy of your Housing Benefit/LHA award letter

- a copy of State Pension award letters and details of any private pensions

*Acceptable proof of income includes recent payslips for those members in work or benefit/tax credit/pension award letters for members out of work or retired.

All supporting documents must be uploaded via the Members Area using the Documents tab

Our staff will be happy to give you any assistance required.

Download our application form here

Loan applications are considered by our team of trained staff. We aim to give you an answer within 5 working days once we have all the supporting information we need.

In deciding whether to grant the loan, our loan assessors will consider your record of saving (if required) and any previous loan repayments, as well as your ability to repay the loan.

Our loan form asks you to declare all your regular expenditure, but sometimes we may have to contact you to clarify the information supplied. Please ensure you take the time to gather information on all your regular weekly, monthly or annual expenses. Be honest with yourself on what you spend where as this will reflect on whether your loan is affordable.

Your application is subject to a thorough assessment which may involve a credit reference check as well as your past experience of credit and other factors. If you have got into difficulties in the past, it won't necessarily stop you having a loan - just give us full details on your application form.

Having a regular savings history and good previous loan repayment history with Discovery Credit Union can help.

Once the loan is granted, you will be sent a link to sign the credit agreement, which is a legally binding document and is your promise to repay the loan and commit to regular repayments. We will also confirm your associated savings plan. Some loans might include signing an alternative means of recovery should you fail to maintain regular payments.

Please remember that taking a loan with Discovery Credit Union, you are borrowing your fellow members' money - never apply to borrow if you're not completely committed to repaying and do not commit to a loan unless you can afford to repay the loan.

By law, credit unions cannot charge more than 3% per month on the reducing balance of your loan - so you are always guaranteed a fair deal! We do not charge arrangement or late payment fees.

Discovery Credit Union believes in rewarding members who save on a regular basis so you will find our best offers are made to members who show a regular savings pattern.

Interest on our loans is charged daily on the outstanding reducing balance - so the quicker you repay the loan, the less you will be charged in interest! We do not charge penalties for repaying loans early.

Discovery Credit Union is flexible with regard to repayment plans and as an ethical lender, we will never force you into paying something you can't afford. You will be advised on the best repayment plan to meet your circumstances. Members are generally advised to repay a loan in as short a time as possible, especially if you are looking to borrow on regular occasions for things like Christmas or holidays.

There is a maximum term for our Discovery Loan. There are legal limitations on the length and amount of loans. Five years is currently our maximum loan term.

Should you experience difficulties in meeting your repayments, we would encourage you to contact us as soon as possible to discuss the situation and we will endeavour to work with you to ensure a fair repayment plan is implemented. We will treat the situation sympathetically and in total confidence. Our staff will discuss with you a suitable way forward. Failure to do so will result in an adverse payment record being filed with the Credit Bureau.

Arrears of loan repayments will be pursued in line with our recovery policy but at every stage of the way, members are encouraged to discuss with staff a suitable way to bring accounts back into line.

We will take all necessary steps to recover monies owed to Discovery Credit Union including the use of external debt collection companies or where necessary, legal action. We may also file for court judgments in certain instances.

Need assistance from our staff?

Contact Us